One of the most asked questions, Should I file a claim?

We get this question all the time. We have clients call us and say, “Hey, I just got into an accident”, “I had a pipe break”, or “I just had a tree fall down”. Should I file a claim?

That is a loaded question.

So what do we suggest? Start with us! Give us a call so we can talk it out, it’s what we are here for!

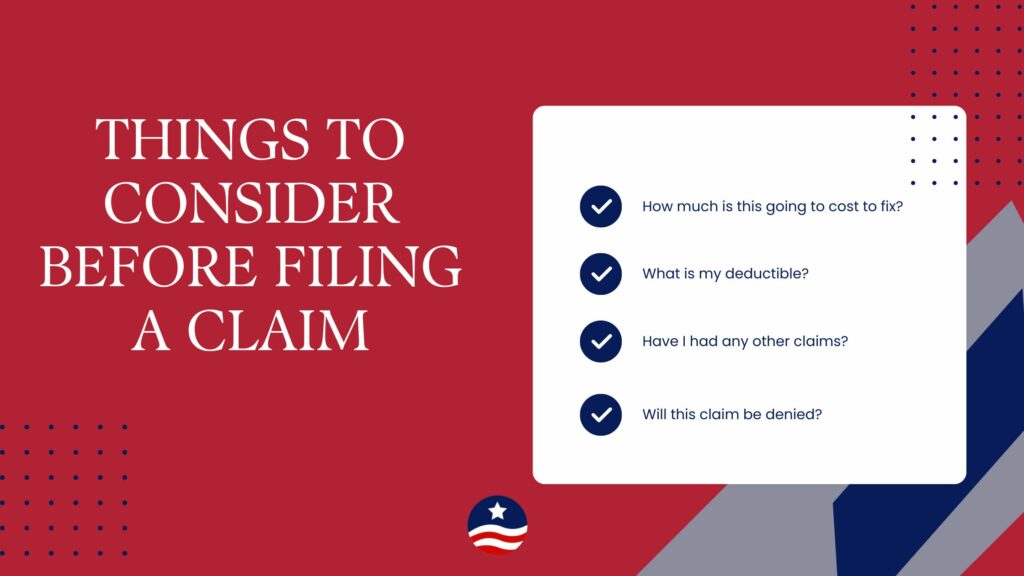

First thing we are going to tell you to do is get an estimate for repairs. Once you have that quote, this is where your deductible comes into play. Every policy has a deductible. So for example, if you get into a fender bender and you go to the collision shop and the collision shop says It’s going to cost me $700 to fix this, and you have a $500 deductible, I’m gonna probably recommend that you do not file a claim. The $200 difference is not enough to warrant a claim on your driving record.

The problem with filing small dollar claims is if you have too many of them, you are going to be dropped by the carrier and/or you’re gonna see tremendous rate increases. It is cheaper in the long run and better for you if you don’t file these little claims.

You have to view insurance as something you use in case of a catastrophic event. Insurance is there for the tree that might come through your living room, a hurricane that might come through the Northeast. Insurance is not there for a leaky roof. A leaky roof is not a good quality claim.

Something every person living in New York should know. If you call a insurance company in New York State and you start asking these questions, they WILL file a claim for you. Even if you call just to talk out a “what if” scenario, if you mention you had a claim they will file a claim. Once that claim is filed there is no going back.

We’ve seen on clients that have come to our office, they have what are called zero dollar claims. What happens is you call the insurance company and ask the question, “Hey, my roof is leaking, should I file a claim?” They will typically file a claim.

When it turns out the damage is not above the deductible the claim will be denied. Unfortunately this claim will still show up on your policy. That claim still counts even though there was no payout. That claim will still count and your rates will go up because there will be a surcharge on that policy.

There is no perfect science to filing claims. Of course you pay for insurance and should use it, but also there are things that should be considered when filing ia claim.

**Every claim and every policy is different, there is no one right way to file, or not to file a claim.**