Cyber insurance is one of the hottest topics in the insurance industry right now.

Most businesses have a small general liability risk, but their cyber risk today has gone up exponentially.

What is at risk?

It has to first be understood the magnitude of hackers these days. There are businesses out there whose only goal is to hack United States-based companies, that is all they do. These attacks are going on continuously, 24/7, 365. There are a lot of vulnerabilities including, your employees, your security process, and your technology.

The first step to protect yourself is to have a conversation with a managed service provider or an IT company, and then get insurance.

Just to get approved for cyber liability insurance, you are going to need a managed service provider, as well as multifactor authentication. The entire market for cyber liability has shifted because the insurance companies have had tremendous losses.

They had to pivot.

Insurance companies have decided to make bare minimum hardware and software requirements for their insureds, and they have increased the number of questions on their applications. That way they make sure that you have the right systems and processes in place before they even insure your business. Completing these prerequisites makes your business far less vulnerable.

In the event that something does get through, you have insurance. We can personally reduce the risk as much as possible, but insurance companies do still take on a large risk.

What will be covered under a Cyber Liability policy?

Privacy Liability

- Covers the cost associated with a breach of defense and indemnity

Regulatory Coverage

- Covers fines and penalties from state and federal agencies including HIPPA.

Security Breach Response

- Covers Breach Response costs associated with: IT Forensics, Notifications, PR Firm, Credit Monitoring etc.

Security Liability

- Lawsuits and costs that arise due to distribution of malicious code

Media Liability

- Coverage applies to your media material for matters such as: Copywrite infringement, liable, slander, etc. The PR nightmare that could occur with you getting hacked

Cyber Extortion (AKA Ransomware)

- Coverage for the extorted funds, and the costs associated with securing the network

Business Income / Digital Restoration

- Reimbursement for the revenue that was lost due to business downtime, and the restoration of digital records.

Payment Card Industry Assessments (PCI)

- PCI fines, penalties, and assessments for loss of credit card information And we also have PCI with credit cards, personal information, things like that are also covered. There is hardware, money, portable devices and payment card information vulnerabilities.

We as small business owners need to protect our information. All it can take is clicking the wrong link and that’s it, they’re in. Now you have a virus on your system. This happens quite a bit to small businesses because they are easy targets. Think of this as the big red bar we used to put across our steering wheels. If a car thief was going through a parking lot and he saw that they would move along to the next car. These security defenses are our “red bar”.

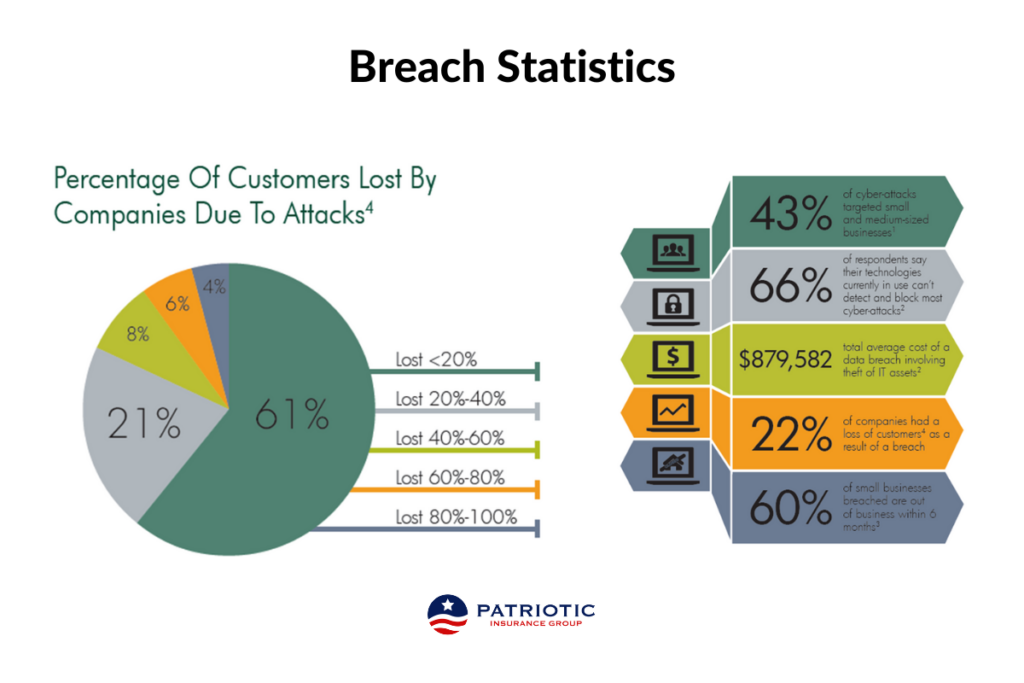

A few statistics for good measure:

A ”Typical Breach”, lets say this is 1000 records. The total loss would be $992,000.

Businessowners say, understandably, those are way more records then they have. So, lets say a quarter of this, that would be $250,000 in losses.

Small businesses don’t have that kind of money on hand, and certainly don’t want to using that much money for a cyber attack.

Cyber security is tricky, as it is constantly evolving and mutating as computers and the web change and evolve. The best thing you can do for your business is arm yourself with the partners that specialize in protecting you, an insurance agent you trust, and managed service provider or an IT company.

For a full video on Cyber Insurance visit out YOUTUBE!

Need a Cyber Quote?