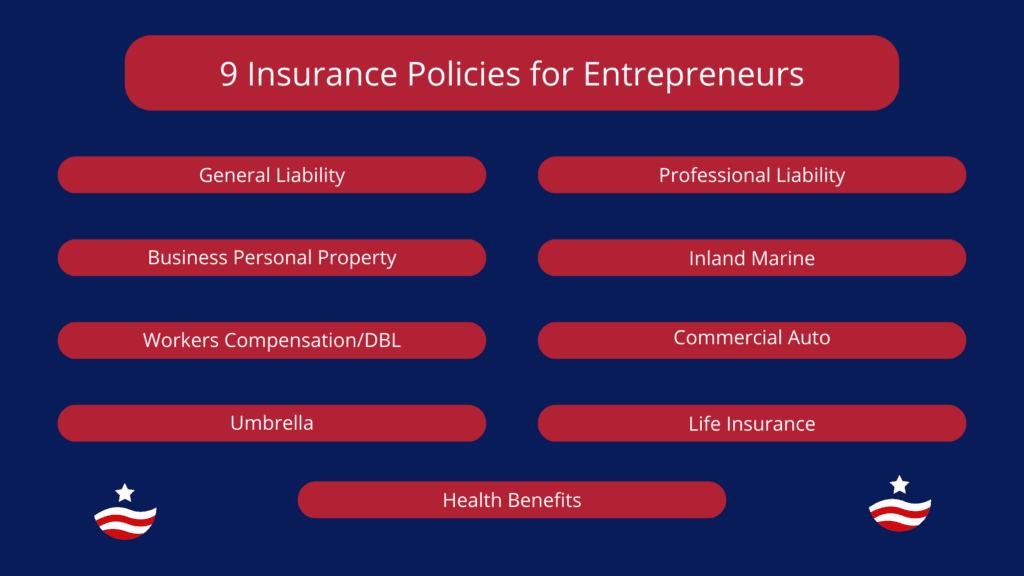

As an entrepreneur, you have a lot on your plate. You are responsible for the success of your business, and that means taking care of everything from marketing to finances to managing employees. One thing that often gets overlooked is insurance. While it may not be the most exciting topic, insurance is an essential part of protecting your business and yourself. In this post, we will discuss the nine insurance policies that entrepreneurs should consider.

1. General Liability Insurance

Every company needs general liability insurance to open the business. This policy provides protection from slips and falls, property damage, and other potential accidents. It is essential to protect your business from these types of claims, as they can be costly and damaging to your reputation.

2. Professional Liability Insurance

Most companies will need professional liability insurance, also known as errors and omissions insurance. This policy provides protection when you and your employees are doing their job. It can cover things like negligence, misrepresentation, and other professional mistakes that could result in a lawsuit.

3. Business Personal Property Insurance

This type of insurance is usually included in the general liability policy, but there are some items that need a separate policy. Business personal property insurance provides coverage for the physical assets of your business, such as equipment, inventory, and furniture.

4. Inland Marine Insurance

Inland marine insurance is a separate policy to insure property owned by the company that is in transit. This includes things like tools, equipment, and other items that are transported from one location to another.

5. Workers’ Compensation and Disability Benefits

Once you have employees and run a payroll, you will need workers’ compensation and disability benefits policies. The specific requirements for these policies vary by state, but they generally provide coverage for employees who are injured or become ill on the job.

6. Commercial Auto Insurance

Many businesses will start adding commercial vehicles for delivery or transport. It is essential to have commercial auto insurance because you cannot use personal auto for business purposes. This policy will cover damages and liability claims in the event of an accident.

7. Umbrella and Excess Liability Insurance

As the size of a company grows, the liability risks also increase. An umbrella and excess liability insurance policy provides an economical way to cover what is above all other policies. This policy provides additional coverage for claims that exceed the limits of your other policies.

8. Life Insurance Buy-Sell Agreement/Key Man Insurance

This type of insurance is for exit strategies or unforeseen disability or death. A life insurance buy-sell agreement ensures that your business partners or family members can buy out your share of the business if you die unexpectedly. Key man insurance is a policy that compensates the business if a key employee, like the CEO or other top executive, dies unexpectedly.

9. Health Benefits, Disability Insurance, Retirement, and Voluntary Benefits

Finally, it is essential to consider health benefits, disability insurance, retirement, and voluntary benefits. These policies allow you to retain and hire good employees. Health benefits can be expensive, but they are essential for attracting and retaining top talent. Disability insurance provides coverage in the event that an employee becomes disabled and unable to work. Retirement benefits are important for employee retention and morale.

In conclusion, insurance is an essential part of protecting your business and yourself. While it may seem overwhelming to consider all of these policies, most start-up businesses will not require all of them initially. As your business grows and prospers, you can add policies to your insurance portfolio to ensure that you are adequately covered.